The tax value of a private car: A comparison by canton

A car is considered as an asset and must be indicated in the tax return declaration. Although wealth tax is not so high compared to income tax, correct reporting is not always a triviality. As tax advisors, we often have to answer one important question: What is the real tax value of a private car?

The tax value of a car depends on:

Canton of residence

Vehicle type

Purchase price

Purchase year

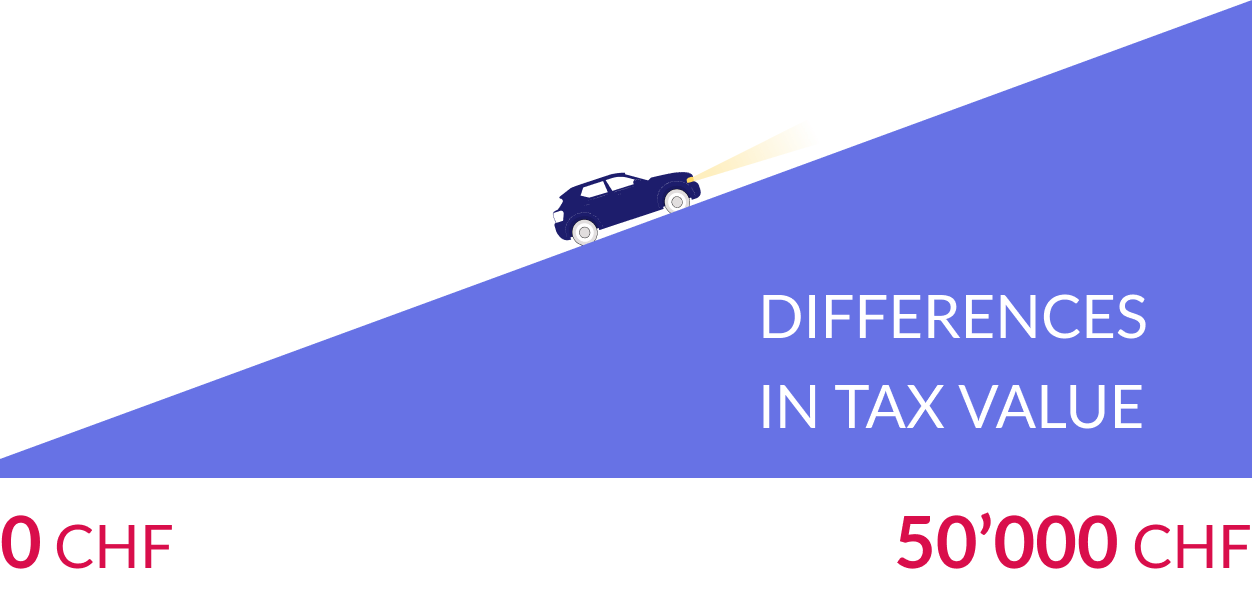

The Swiss tax system has its peculiarities in taxation mechanism. The tax value of the car can significantly vary from canton to canton. For example, a car in Basel-Stadt may be taxed at the value of CHF 0. However, in Schwyz, the value of the identical car can reach up to CHF 50,000.

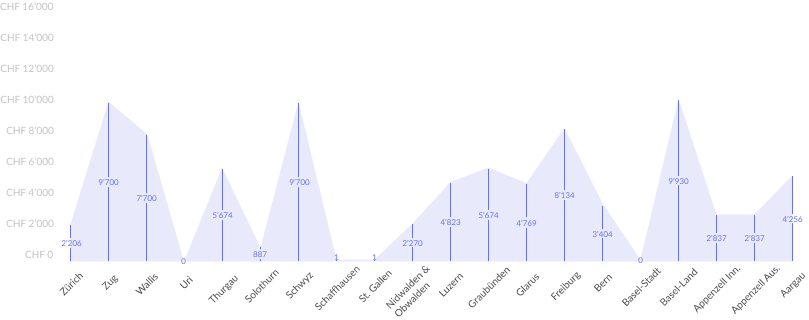

Below is a brief overview of the most important valuation rules by canton.

Click on the individual canton and find out how does the value of a car change over time.

|

Canton |

Tax value in 1st year |

Depreciation method |

Depreciation rate |

|---|---|---|---|

|

Aargau |

70 % of acquisition value |

Declining-Balance |

30%4 |

|

Appenzell Ausserrhoden |

80 % of acquisition value |

Straight-Line |

20% |

|

Appenzell Innerrhoden |

80 % of acquisition value |

Straight-Line |

20% |

|

Basel-Land |

70 % of acquisition value |

Declining-Balance |

30%5 |

|

Basel-Stadt |

- 1 |

-1 |

- 1 |

|

Bern |

65 % of acquisition value |

Declining-Balance |

35% |

|

Freiburg |

30 % of acquisition value |

Declining-Balance |

20% |

|

Glarus |

70 % of acquisition value |

Declining-Balance |

30% |

|

Graubünden |

60 % of acquisition value |

Straight-Line |

10% |

|

Luzern |

70 % of acquisition value |

Declining-Balance |

30% |

|

Nidwalden |

60 % of acquisition value |

Declining-Balance |

40% |

|

Obwalden |

60 % of acquisition value |

Declining-Balance |

40% |

|

St. Gallen |

80 % of acquisition value |

Straight-Line |

20% |

|

Schaffhausen |

60 % of acquisition value |

Straight-Line |

20% |

|

Schwyz |

- 2 |

- 2 |

- 2 |

|

Solothurn |

50 % of acquisition value |

Declining-Balance |

50% |

|

Thurgau |

80 % of acquisition value |

Straight-Line |

20% |

|

Uri |

60 % of acquisition value |

Straight-Line |

20% |

|

Wallis |

- 3 |

- 3 |

- 3 |

|

Zug |

60 % of acquisition value |

Straight-Line |

10% |

|

Zürich |

60 % of acquisition value |

Declining-Balance |

40% |

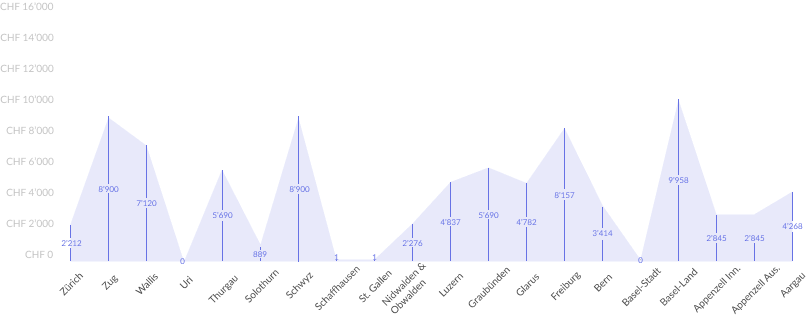

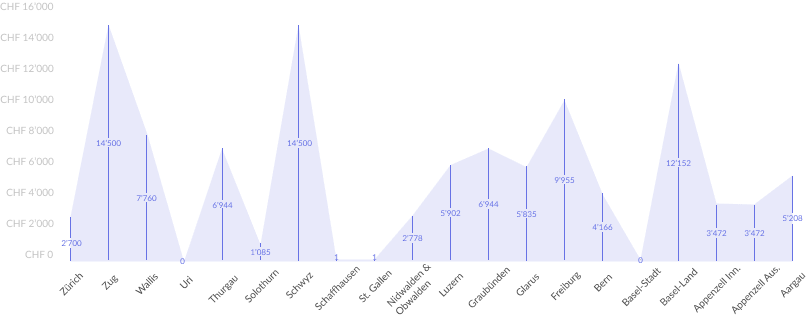

For a better overview, we have prepared three detailed case studies for you. Skoda Octavia, VW Golf, and Audi A3 are the most popular vehicles in Switzerland. Assuming that all three cars were purchased in 2016, we calculated their exact tax value in different cantons.

You can find more interesting articles on this topic here:

41323

Important: All vehicles that are physically located abroad must also be declared in Swiss tax declaration.